EPFO Passbook – PF Balance Check, Contribution Details & PDF Download

EPFO Passbook is an online record of your Provident Fund (PF) account, where all PF-related details are clearly stored in one place. This passbook is provided by the Employees’ Provident Fund Organisation (EPFO). With the help of the EPFO Passbook, any employee can check how much PF is deducted from their salary every month and what the total balance is in their PF account.

In today’s digital era, the EPFO Passbook has made it very easy for employees to access PF-related information. Now, there is no need to visit government offices or depend on any agents.

Friends, in this article we will learn how to check the EPFO Passbook online, how to download it, why it is important, and what information is available in the EPFO Passbook. Let’s get started.

What Information Is Available in the EPFO Passbook?

The EPFO Passbook works like a bank passbook, but it is completely online. The important details available in the passbook are listed below:

- Monthly PF contributions

- Employee’s contribution (12% of salary)

- Employer’s contribution (3.67%)

- Amount deposited in the pension fund

- Interest earned on PF

- Month-wise details of deposited amounts

- Total available PF balance

How to Check EPFO Passbook Online?

To view your EPFO Passbook, your UAN must be activated. If your UAN is active, follow the steps given below:

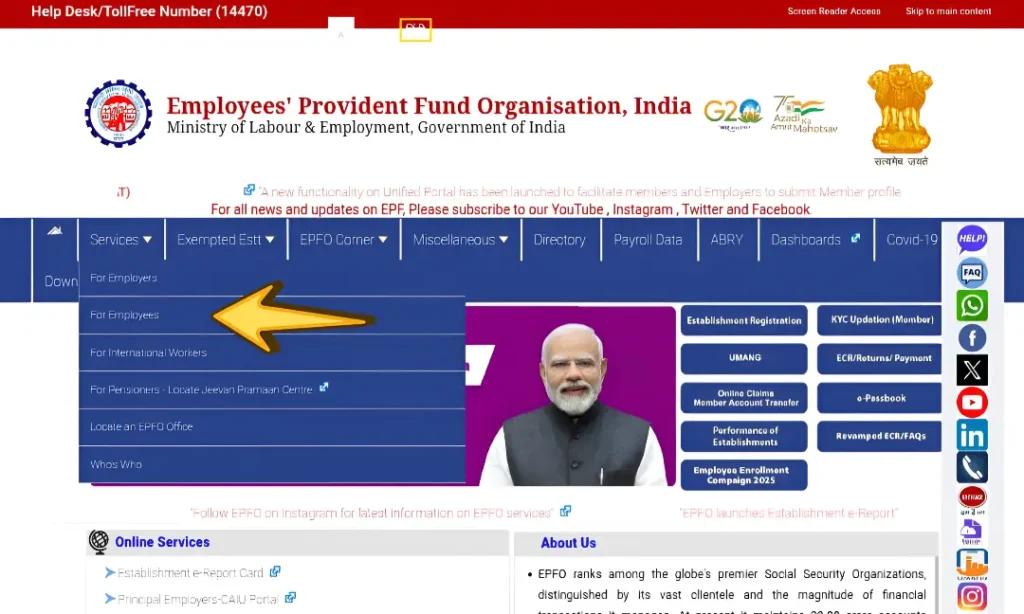

- Visit the official EPFO website.

- Click on Services

- Select For Employees

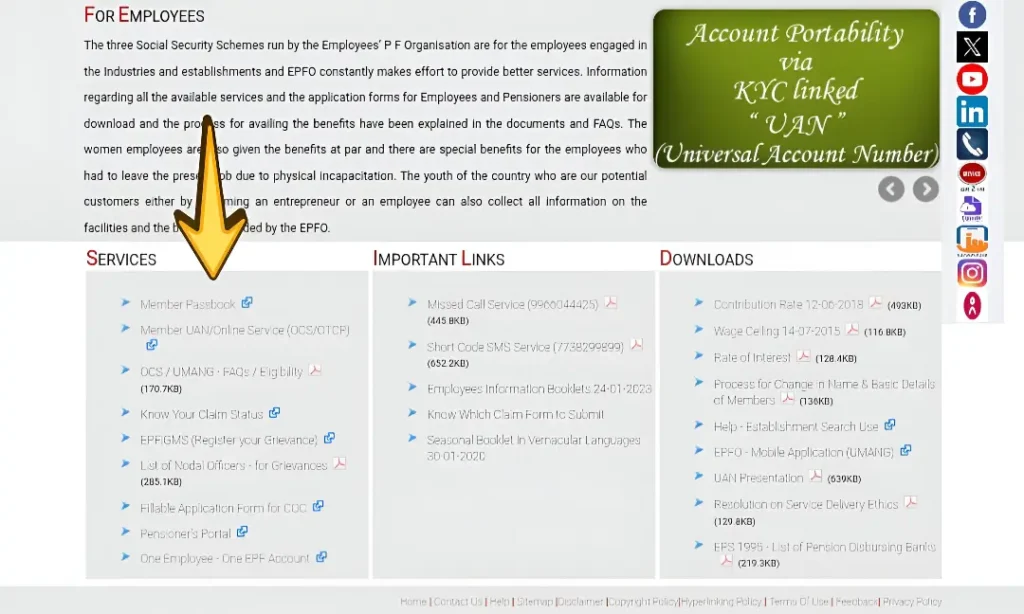

- After that Click on Member Passbook

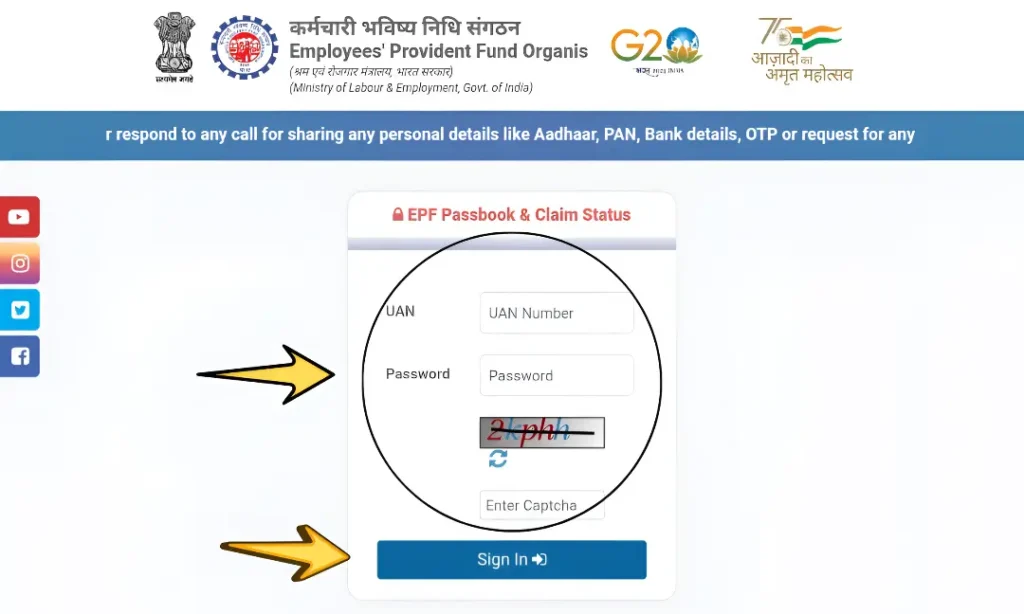

- Log in using your UAN number and password.

- Verify the OTP sent to your registered mobile number.

- Your EPFO Passbook will open on the screen.

How to Download EPFO Passbook PDF?

You can also download your EPFO Passbook in PDF format, which can be useful in the future.

- Open your EPFO Passbook.

- Click on Download PDF.

- Save the file on your mobile or computer.

Why Is EPFO Passbook Important?

The EPFO Passbook is very useful for every employee because it contains important PF-related information. Some key benefits are:

- Check PF balance from home

- Verify whether the employer is depositing PF on time

- Keep track of monthly PF contributions

- Helps in planning PF withdrawal and claims

- Complete transparency in PF records

Frequently Asked Questions (FAQs)

Q1. Can the EPFO Passbook be downloaded in PDF format?

Yes, after logging into the EPFO portal, it can be downloaded in PDF format.

Q2. What is required to view the EPFO Passbook?

To view the EPFO Passbook, your UAN must be activated, your mobile number should be linked with UAN, and you must have the EPFO portal login password. After OTP verification, you can view the passbook.

Q3. How can I check my EPFO Passbook?

You can check it by logging into the EPFO portal using your UAN and password, then going to the Member Passbook section.

Q4. Why is it important to check the EPFO Passbook?

It is important to check PF balance, employer contributions, and claim-related information.

Q5. How much contribution does an employee make in the EPFO Passbook?

12% of the employee’s salary is deducted as PF contribution.

Conclusion

The EPFO Passbook is an important online facility that allows employees to maintain full control over their PF funds. Through the EPFO portal, checking, downloading, and understanding the passbook has become very easy. Employees should regularly check their EPFO Passbook to avoid any future issues.